Welcome back to the second installment of our series on preapprovals. Last week, we learned what prequalification, preapproval, automated underwriting and fully underwritten preapproval mean.

Today we are going to talk about the advantages and potential disadvantages of each and how you can best utilize your Key Mortgage loan officer to figure out what works for your client.

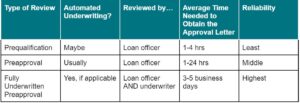

Let’s look at a chart of the various types of pre-contract reviews and how they stack up:

It’s not surprising to see the fully underwritten preapproval is the most reliable and offers the strongest commitment to lend due to the fact that it is reviewed by an underwriter. Key Mortgage leverages our SecureShop preapproval to give borrowers (and potential sellers and agents) the peace of mind the loan can be approved. It is also now FREE as part of our Buyer Success Bundle, which can be a very powerful value proposition to both your buyers and sellers and lead to a FASTER closing.

This chart illustrates that the loan officer yields a lot of power in the review and generation of any preapproval letter. Vetting that loan officer on what level of review they performed, what documentation they received and if they utilized automated underwriting should be a critical part of this process.

This is why having the loan officer you know and trust to perform this can have huge advantages. That is why our $250 Second Look option is a huge plus — your client gets a second opinion on their preapproval and $250 no matter what. Knowing we win that client almost 70% of the time shows that the client finds it to be a huge advantage too.

So, as we go about structuring business plans for 2024, don’t forget to leverage your Key Mortgage partner when a client is looking for a preapproval. Reach out to a Key Mortgage loan officer today!